Grant Progress Reports

Cut your progress reporting time by 20 minutes per grant by answering three questions on a web form. We’ll take a look at the grant progress reports in Tempest-GEMS. With FEMA and other federal granting agencies, applicants are encouraged to provide progress reports each quarter.

We are coaching you on grant management best practices using grant management software. If you appreciate this presentation, please share it.

Subscribe to our YouTube Channel

Progress Reports

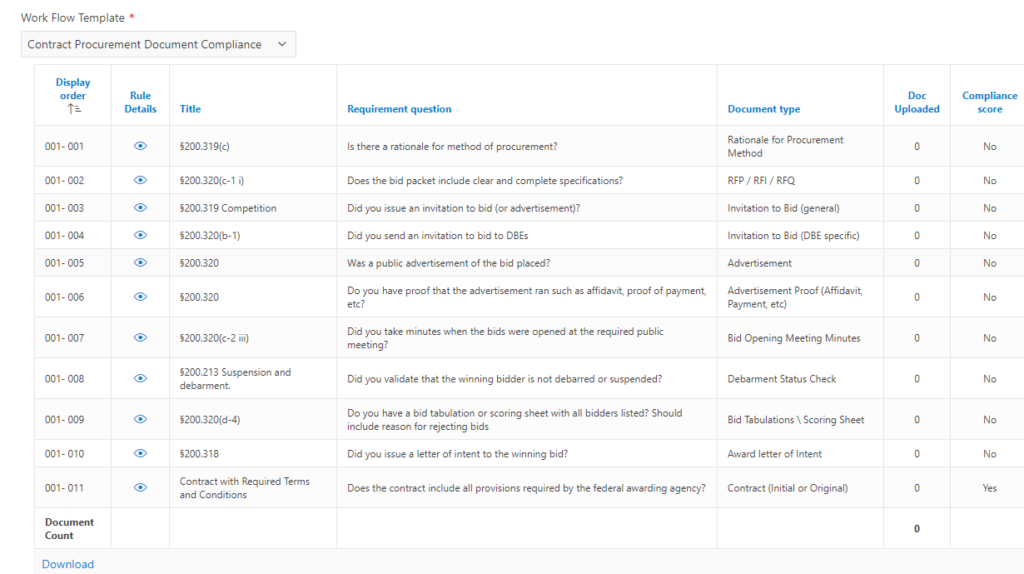

Progress reports occur as a part of the dynamic between the grant execution team, also called the sub-recipient, and the state’s grant administration team. The questions that the grant managers, or applicants answer come from the state. Here at Storm Petrel, we modify this process to meet the state’s needs. Quarterly, the applicants are asked to identify if the scope is sufficient, funding is sufficient, and if there is progress on the mission.

The state reviews and summarizes for the federal granting agency.

Creating Progress Reports

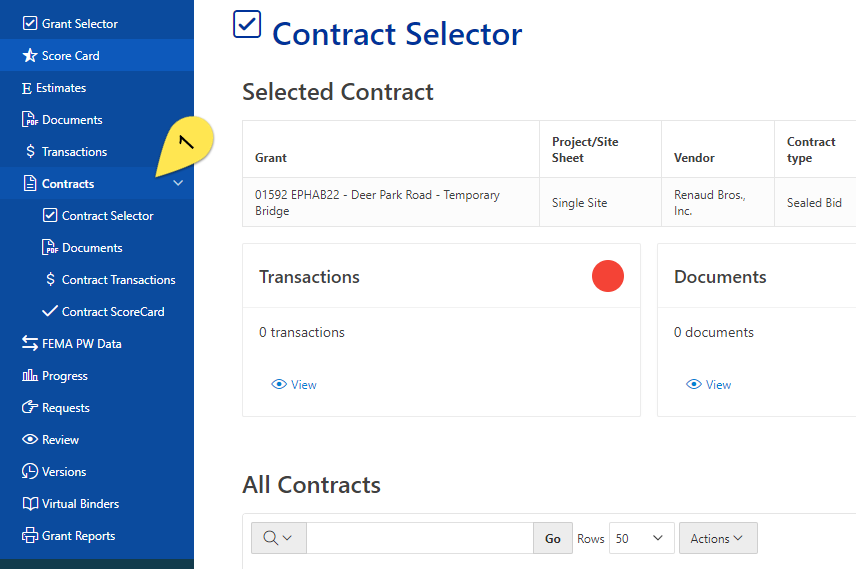

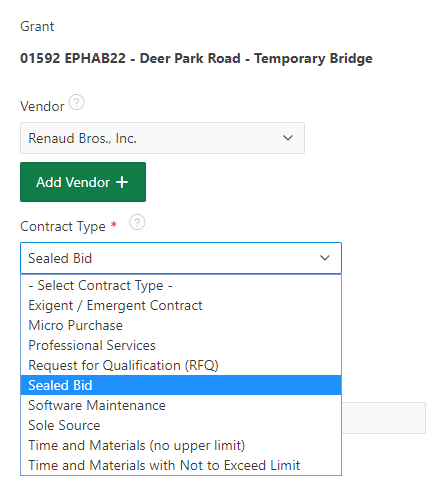

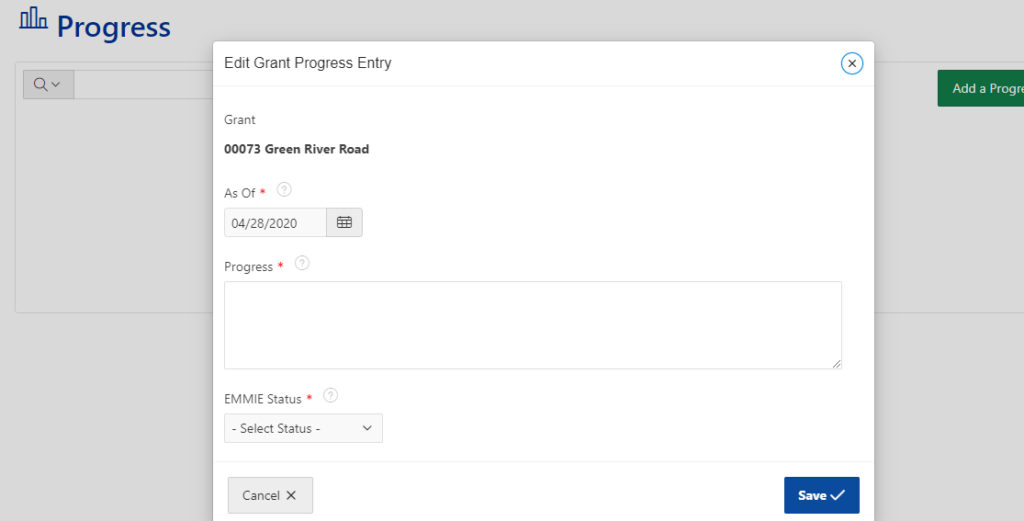

The progress reporting process is specific to a grant. Open the grant menu on the left to find progress – it has a bar-chart for an icon. Click the green button to add a progress report. Answer the questions from the state then hit submit.

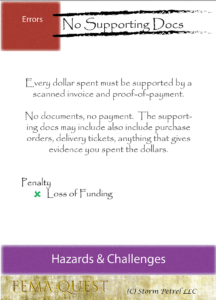

The questions normally focus on your activities and needs. It is an early warning or early detection system. A key risk with larger disaster grants is abandonment. Success is accomplished with regular steady work. The quarterly progress reports reinforce this message.

Reviewing of Progress Reports by States

With each cycle of progress reports, the state reviews the effort with workflows and reports in Tempest-GEMS. The action taken by the state is for them to decide. Maybe the reports get sent to FEMA, maybe just summarized.

Communication is Key

Progress reports keep communication going between the state and the applicant. The effort reminds people to review grants, reimbursement status, data entry activities, and others factors, then document the situation.

We are providing you a Power Tools card on Progress Reports. We strive to reinforce successful grant management practices.

Power Tools Cards on Progress Reports