Grant Labor Cost Reporting

Halve the time it takes to enter and calculate labor, equipment and materials costs, while omitting errors using one simple tool. We all want FEMA assistance, but some of the FEMA grant accounting basics take some training and getting used to. Join us while we learn how to manage disaster relief grants and report labor costs.

We are providing grant management best practices so that you and your team will learn how to manage FEMA grants. If you appreciate this presentation, please share it.

Subscribe to our YouTube Channel

Labor, Equipment, & Materials Costs

Reporting the true costs of using your labor force for executing a FEMA-funded grant requires some extra steps. You’d think a payroll report is enough. While detailed payroll records are required, it’s the starting point. Your payroll data shows all hours worked, using the payrates for employees. Whereas FEMA wants you to report only the hours worked performing eligible tasks – tasks described within the grant’s scope of work. And the rate FEMA reimburses you includes benefits, taxes, and related costs. FEMA calls this the Fringe Rate – I often think of it as the “FEMA billing rate”.

Prior to calculating and reporting labor and equipment costs, you’ll have setup your staff and equipment in Tempest-GEMS. We cover this in: “Setting Up for Labor, Equipment & Material Cost Reporting”.

From this starting point, we’ll examine how to enter and calculate labor, equipment and materials costs, while omitting errors using Tempest-GEMS. We will then look at the reporting process. If you are an applicant using Tempest-GEMS and your state is also on the system, you use the Request feature. If you are an applicant using Tempest-GEMS and your state is not on the system, then you create FEMA reports as a means of asking for reimbursement.

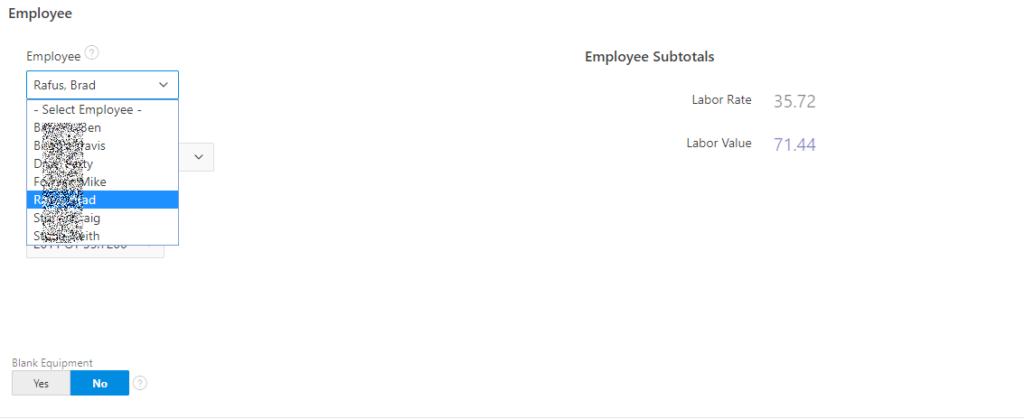

Force Labor, Equipment, & Materials

To start, we click on the grants menu then the transactions. We can add (green buttons add) or edit an existing labor, equipment, and material record now – which is also called “force account”. Every transaction inside of Tempest-GEMS is given a unique number. I have heard people reference these numbers in conversations and emails because they are precise and unique. A force account entry is work done by your people, or your equipment, on a given day that satisfies some element of the scope of work.

Make sure that the date falls within the performance date of your grant. All FEMA assistance grants have a start performance date and an end performance date. Your work date must be between start and end. If it is not, it is not eligible.

The activity description field should be used to provide a description of the work that is clearly scope-eligible. If the scope says pick up yellow dots, then the work description should kinda be similar to that. Then we inform Tempest-GEMS how many hours we worked.

Knowing grant management best practices and understanding the challenges others have had with the FEMA Public Assistance Grant Program provides you the foundation for knowing what to emphasize. Each element, each data entry point, will either enhance and improve your ability to recover money from FEMA – or it will create problems.

Some of these little fields link raw data to your mission. Of course, you must type a work description that is backed by physical evidence such as timesheets or worklogs. Can’t lie. So use the truth to enhance your posture!

Tempest-GEMS links a work entry to a piece of equipment. This is important during weather-based disasters – Billy Bob driving a big yellow truck with 4 culverts. It maybe less important during the COVID-19 emergency work. People are not removing debris from roads or fixing damage. Your reporting for COVID-19 will likely have employees! So yes on that.

Employees

When would you not have an employee with one of these records? The most common answer is a generator. Other answers can include large light sets, or stand-alone equipment. For the COVID-19 disaster, I’m going to emphasize labor costs.

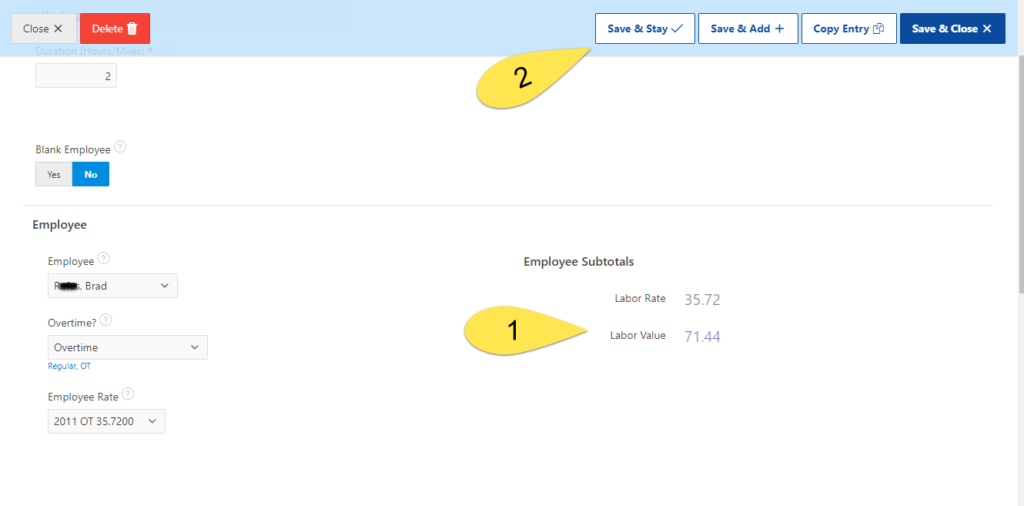

Automatically Calculates Labor Value

So, yes in our example there is an employee. We’ll pick one from our list. The system will offer us the rates that we previously put in. Click, click, pick a rate and it has calculated the labor value for us.

How fast is this? I type in (or select) the date. Type a description (maybe I keep one in my copy buffer because I’m efficient). Type the hours and hit tab. Tab, tab to get the employee. I type the first letters of the last name, and hit tab, type the “O” for over time, hit tab, select my rate. Done. A touch typist is done in seconds. With a mouse it is a little slower because a hand shifts between the mouse and keyboard.

Is this faster than Excel? Not only yes, but unlike Excel Tempest-GEMS pulls from data that is already set up.

Given speed and efficiency is our goal, we provide power-up tools for moving along. Copy Entry takes this data and make a copy. Change the date, copy again. You’re flying through a week!

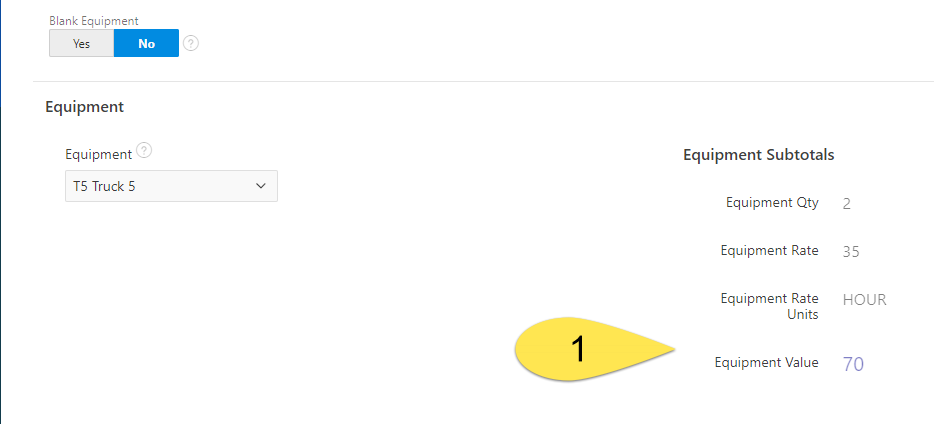

Choosing Equipment

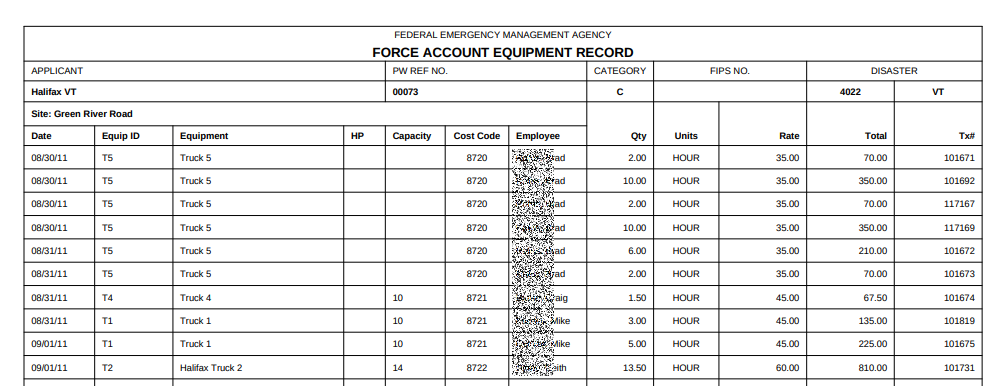

What happens if you do have an operator and equipment together like Billy Bob on his big yellow truck? Well, we go onto the next section and pick the equipment. Done. It knows the hours. And Billy Bob and his truck are entered in one effort.

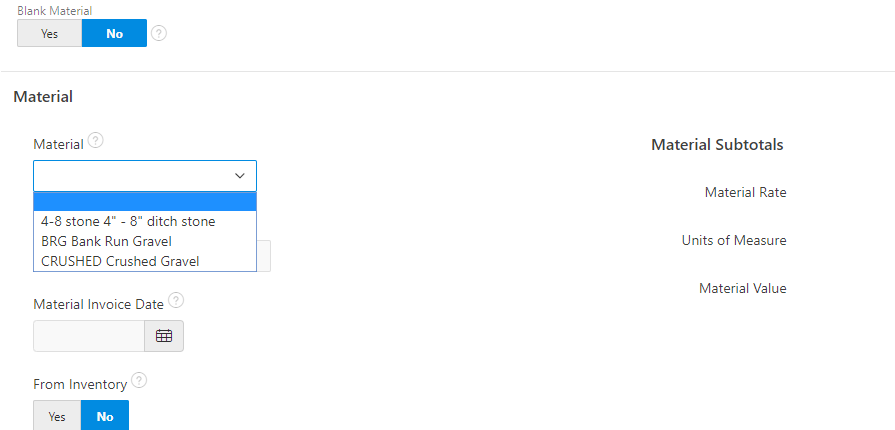

Materials

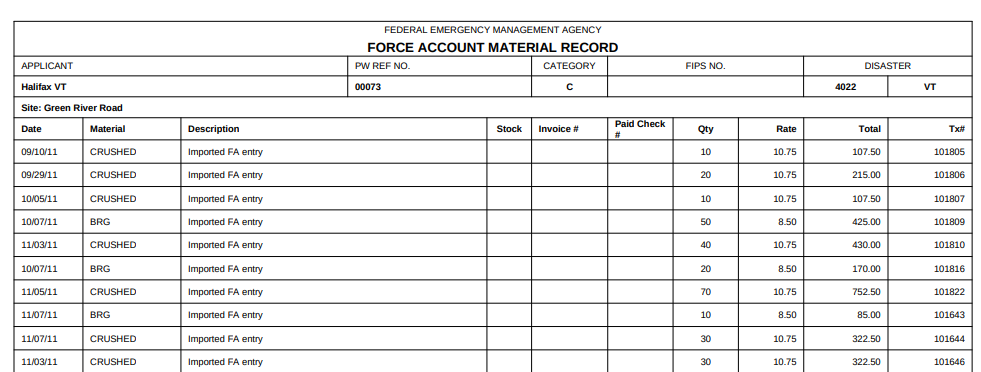

And if Billy Bob put culvert or gravel in his truck from your yard or inventory? Make that selection and move on.

Summary

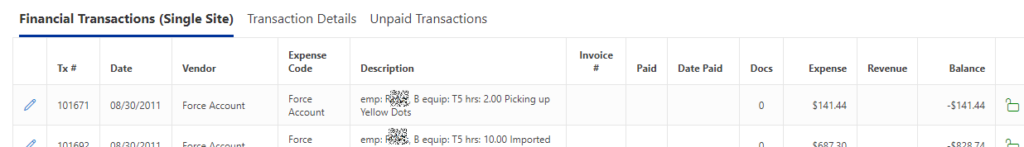

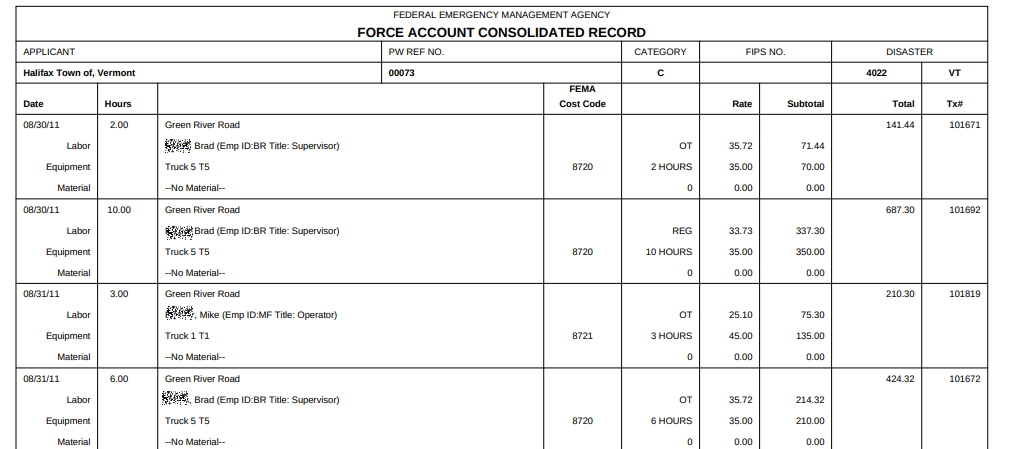

Here’s your summary. We’ve built a single record describing work. Billy Bob, or Brad, as my examples show, worked 2 hours of Overtimes on the 30th of August and he was driving Truck number 5. The total value of this entry is: $141.44.

Don’t Take Shortcuts

Data entry of labor is an on-going task. I am going to make a pitch for doing it in the most detailed fashion possible. Shortcuts often backfire, more often backfire. If you have a time-keeping system that can accurately show the eligible work, the employee, date and work description that also uses the fringe rate, then you are way ahead of most. Some systems and some Wizards can make this happen. It has to follow the same rules and be 100% accurate. If done well, you can do data entry into Tempest-GEMS in batches. Just click “Add Expense” and select your expense type as “Force Account”.

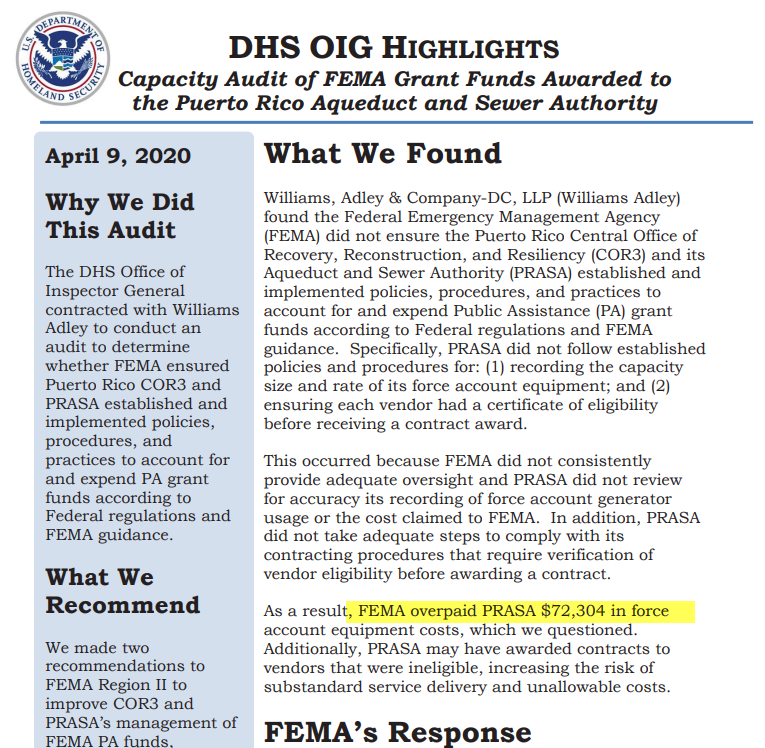

90% of the people I have seen use this trick end up with rejected entries. In April 2020, the OIG published negative findings from Puerto Rico about the water and sewer agency. They took shortcuts that resulted in massive losses.

Let’s move forward. We need to report labor costs. FEMA has standard reports for this process. I’ll list them and show a picture of Tempest-GEMS reports. This is under the grants reports menu. FEMA Force Account Labor Record, FEMA Force Account Equipment Record, FEMA Force Account Material Record, and the Force Account Consolidated Record. The first three are bog-standard FEMA reports – been around for decades.

Our favorite and recommend report is the Force Account Consolidated Record. This report clearly shows that the labor, equipment, and material are linked. The reviewers and auditors have an easy time seeing that Billy Bob is on his big yellow truck. Or Brad is working 2 hours on Green River Rd in Truck 5 which has FEMA cost code of 8720 and he had no materials in his truck.

If you do not have to report operator and equipment, as is likely with the COVID-19 disaster, the FEMA Force Account Labor record is more concise.

For reporting labor costs, you will need detailed labor records – as shown and generated from Tempest-GEMS – or another tool.

And you will need the detailed payroll records. You’ll need the worklogs that demonstrate the work fit within the scope of the grant. You’ll need the payroll reports and information showing the full costs of the payroll. And you’ll need some sort of proof of payment. FEMA varies on this a bit. Best to have it. Some banks or payroll companies provide ACH summaries. Get these scanned and uploaded to Tempest-GEMS. You can upload as “grant documents” – label it well so the reviewers know this pile is for the pay period X to Y. Or you can upload the entire thing on the first data entry point for the pay period. I tend to use the grant document process. It’s easier to see.

Request for Reimbursement

If you are an applicant in a state where Tempest-GEMS is the official system, then you’re in luck. You’ll make your request for reimbursement within the system. It is called a Request. We’ll cover this in another episode.

For others, your Request for Reimbursement process will be dictated by your state. Typically, it involves a cover letter on letter head. The letter states: “We’d like some money please and we’ve got these documents to support our claim.”

Then you bundle up your documents.

A little warning: FEMA does not accept thumb-drive or USB memory sticks. Many states do not either. Most email systems will prevent emailing attachments with more than 25mb. So in this world people still burn CDs with data, and hopefully your state has this problem solved for you.

Force Account Reimbursement

Reporting labor, equipment, and material costs involves several components. First, the work you report must fall within the performance dates for your grant. Second, the work described must match the grant-funded mission. Tempest-GEMS helps with these tasks.

Then you need to report the eligible hours and calculate labor costs using your fringe rates for the staff – a number that is higher than your payrates.

If you have equipment, then you normally have to show that it also has an operator with the exception of generators, pumps, and light-sets. If it has a seat, windshield, or a handle, FEMA will most likely expect to see an operator.

Force account reimbursement can also reimburse you for materials used from your inventory. Tempest-GEMS links these three together in reports designed by FEMA.

Please share this material with colleagues. Post about us and our efforts on your favorite social media platform. And don’t forget to grab the Labor Reporting Guide to help you get started with FEMA Quest.

Labor Reporting Guide