Big Purchases With Grant Funds

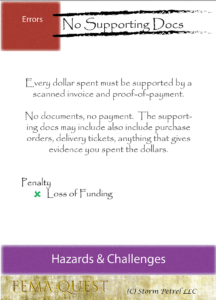

Avoid the number one failure that causes the DHS OIG to recommend grant clawback, and keep your hard-won grant funds working in your community. In our FEMA Quest game and in our game cards, we call this the Land of Eleven. The reason is that there are eleven essential steps which will generate at least eleven documents. Get eleven documents, and you’re likely following grant management best practices. In this episode, we learn how to make big purchases with grant funds.

We are providing grant management best practices so that you and your team will learn how to manage FEMA grant accounting basics. If you appreciate this presentation, please share it.

Subscribe to our YouTube Channel

Large Purchases Defined

What is a large purchase? A large purchase is defined in procurement policy, or it should be. If you have a policy, you should define this threshold. If not, you fall on your state’s policy and their threshold. If they don’t have one, then you use the federal policy.

The federal policy uses the Simplified Acquisition threshold which is normally $250,000. Some funny things happened to it during the spring of 2020.

I looked up Arizona’s policy. Their policy stated that in the event of federal funding their policy guidelines revert to the federal. If you live in Arizona, your threshold is that Simplified Acquisition threshold above.

I looked up Virginia’s policy. They did offer a definition basically $100,000 (§ 2.2-4304. Methods of procurement G.1.)

That’s a lot of words and gibberish.

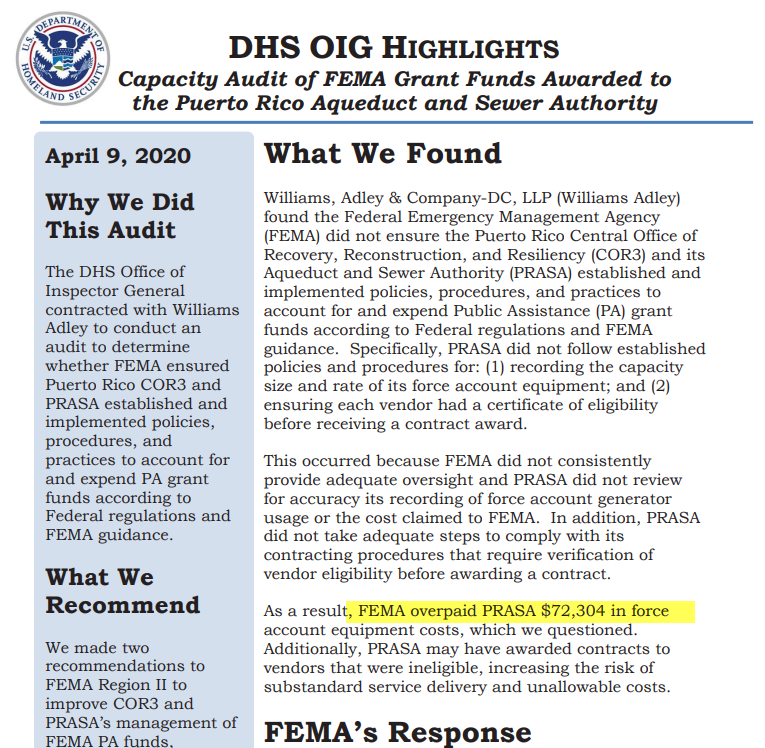

The Eleven Steps of Grant Management

Let’s make a short cut. When in doubt, use a competitive procurement process. It takes eleven steps, cost a few dollars. With COVID-19 emergency, there is printed guidance from FEMA about single-sourcing. That guidance precisely follows the law and matches 2-CFR-200. It seems tempting to sole-source – but please don’t. It will come around and sting years down the road. The warning is that FEMA and the OIG have a short memory. After a few lovelies abused this process, there will be scrutiny on all of us! Single source seems attractive, people will have failures and rejection because some costs are not reasonable. Oops.

In this episode, I am going to go through the eleven steps as they relate to the policy. Then I’ll show you how to set that up in Tempest-GEMS and how using grant management software, provide guidance, and scoring.

You’ll do best thinking of this as a game. Earn points here to protect yourself from bad stuff. And that is good.

Competitive Procurement “Hints and Hacks”

On the FEMA Quest Competitive Procurement “Hints and Hacks” card, you’ll see the eleven steps needed for this effort. When making big purchases with grant funds, you’ll want to follow this list.

- Create a written rationale for the procurement method. Could be a memo, an email, or a motion at a meeting. State you are using a competitive process because it is a large purchase.

- Create a bid packet with clear and complete instructions. For construction, this is a lot of work. For other goods and services, it can be simpler. Reference common phrases and definitions.

- Issue invitations to bid. Grab a copy or screen shot of that effort in PDF.

- Invite disadvantaged business entities or what ever they are called in your state. Typically you can email a state agency to send this out for you. Grab a copy of the email in PDF.

- Advertise publicly. Grab a copy or screen shot in PDF.

- Capture the proof of payment for an ad. If no paid ad, state that. In PDF, of course.

- Hold a public meeting to open the bids. Take minutes. Make a PDF of the minutes and the attendance roster.

- Validate the winning bid is not debarred in sam.gov. Keep the PDF.

- Do a bid tabulation or scoring sheet. Keep them all, make PDFs.

- Write a letter of intent to the winner. And yes, keep the PDF copy of that.

- Write a contract that includes all of the provisions you find in your grant (Clean Water Act, Davis-Bacon, etc).

That’s eleven. The Land of Eleven!

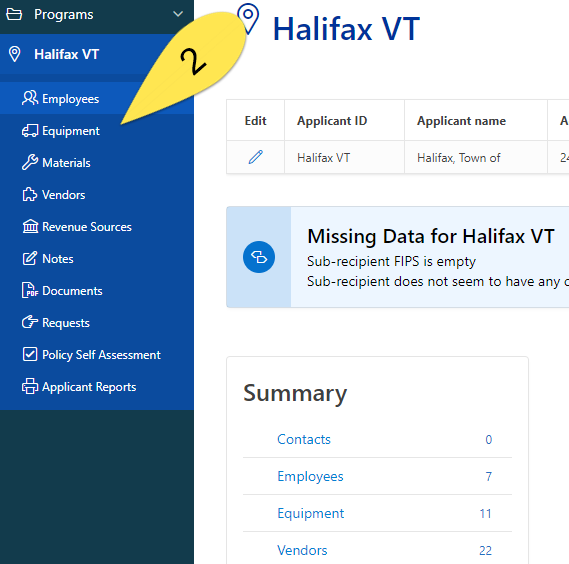

The Contract Tool

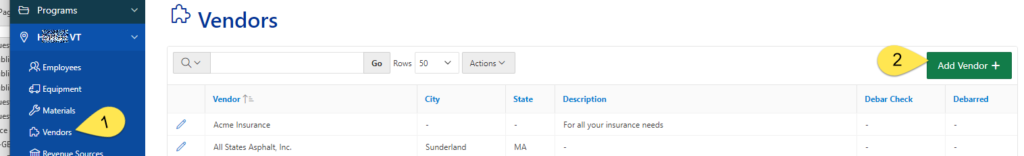

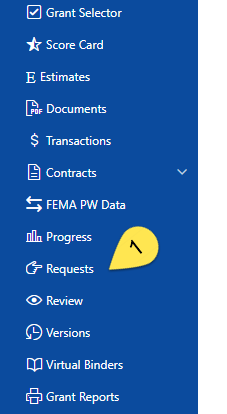

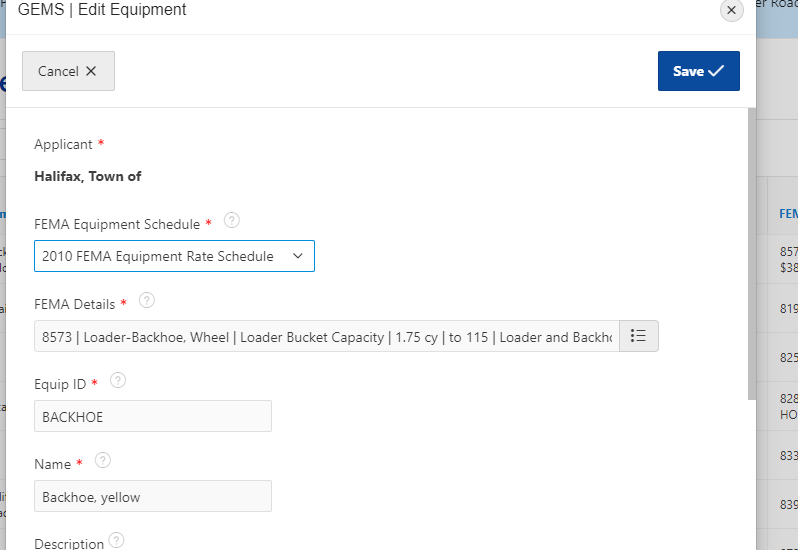

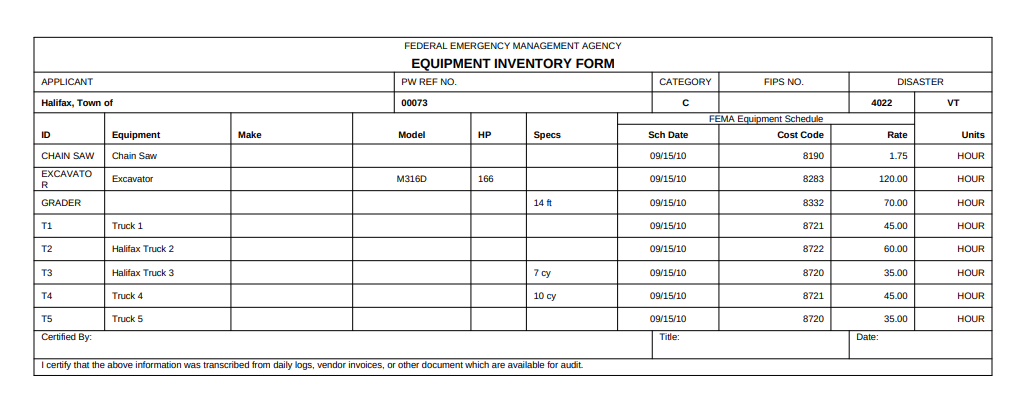

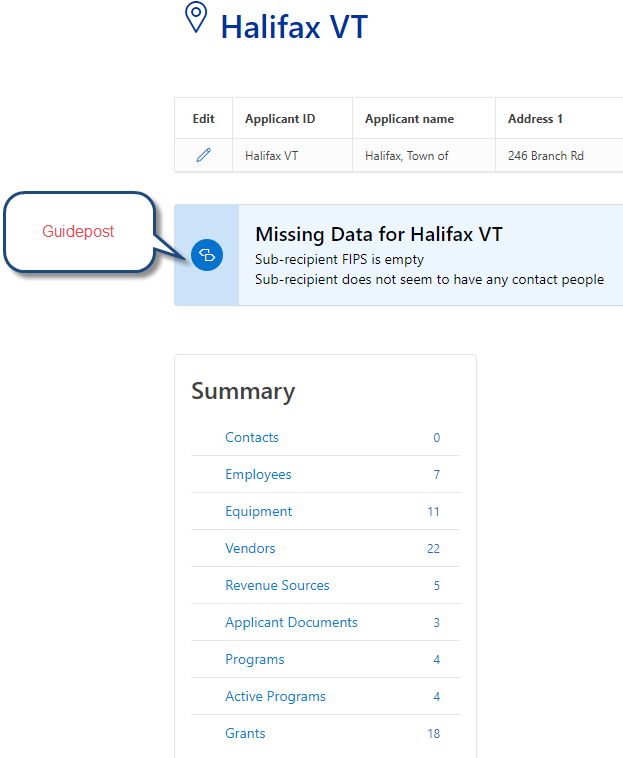

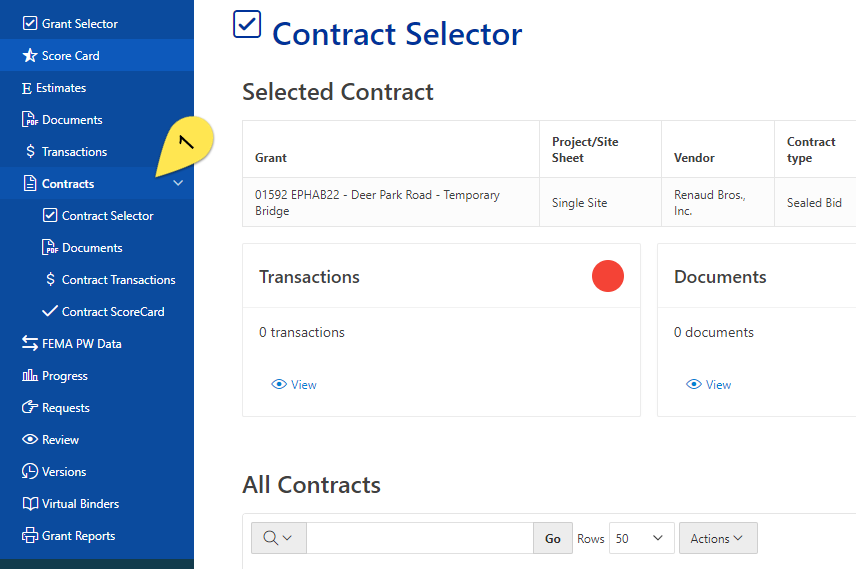

In Tempest-GEMS, we’ll use the contract tool to help us. Let’s assume you’ve set up the vendor. That was covered in the small purchase episode. That’s an easy step. You’ll find vendors on the menu below the name of your Applicant. The icon is a map pin.

The Grants Menu

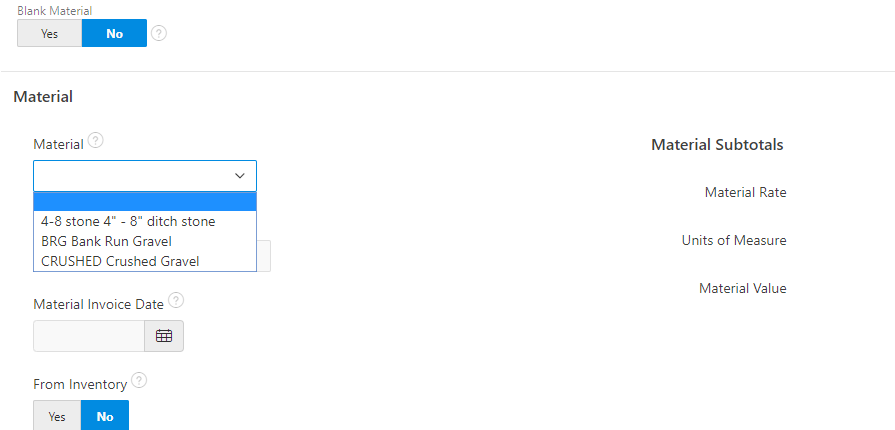

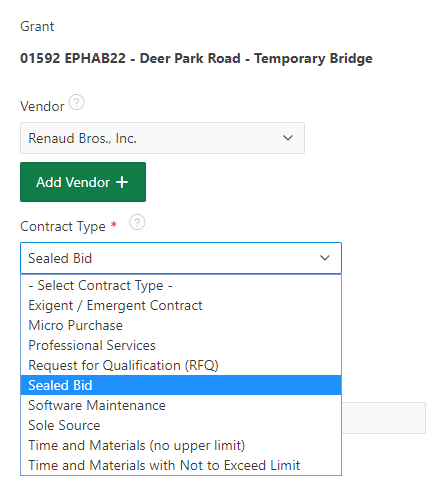

With a Vendor defined, go to the Grants menu, then the Contracts menu as shown in the illustration. You’ll add a contract (green-buttons add). Select your vendor, then pick your contract type. This will be sealed bid. Give it a name and save it. You can do all sorts of data entry, or skip it. The system can track amounts, dates, and such. Up to you.

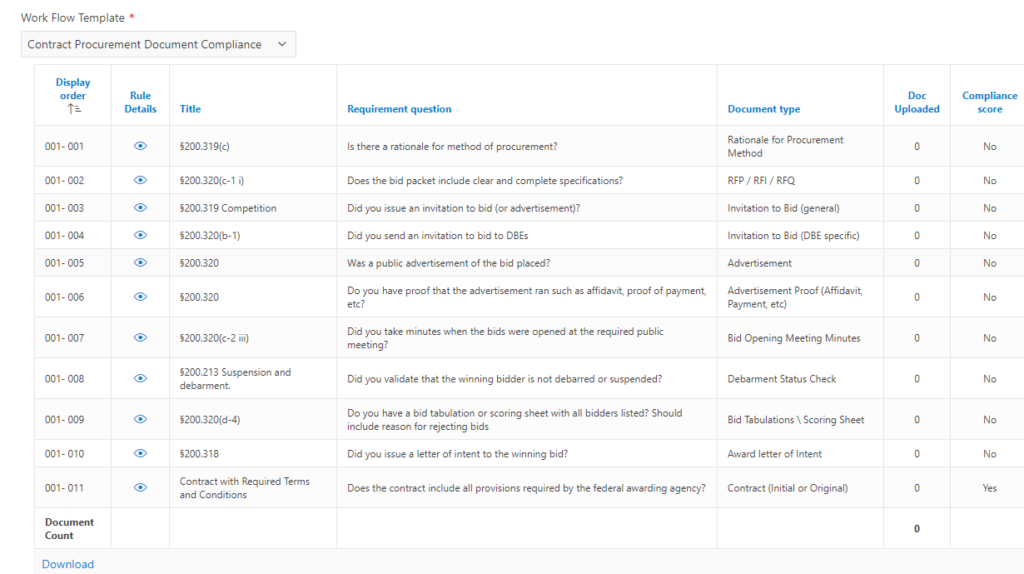

The Contract Scorecard

Here is the contract scorecard. Each of the eleven steps are detailed. We have the reference to the law, 2-CFR-200. The eyeball icon shows you the exact text and can even take you to the government’s website for more details.

Each document you upload, you get a point. Eleven steps, eleven documents.

Uploading Documents

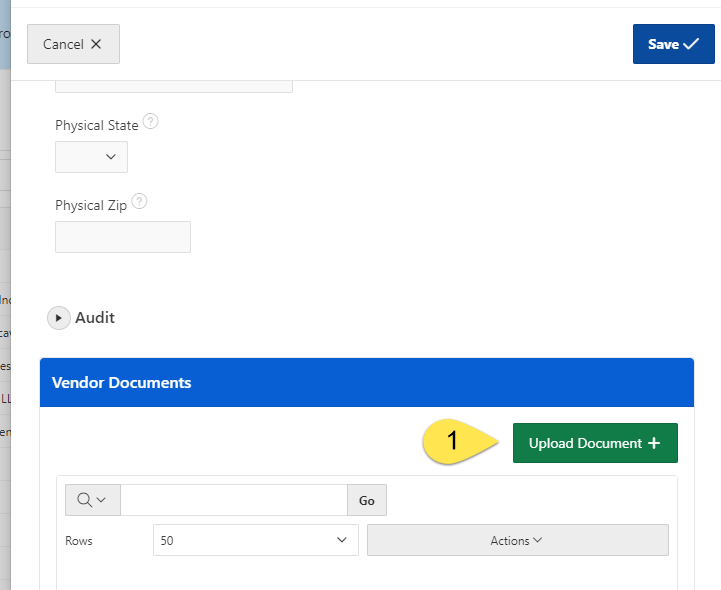

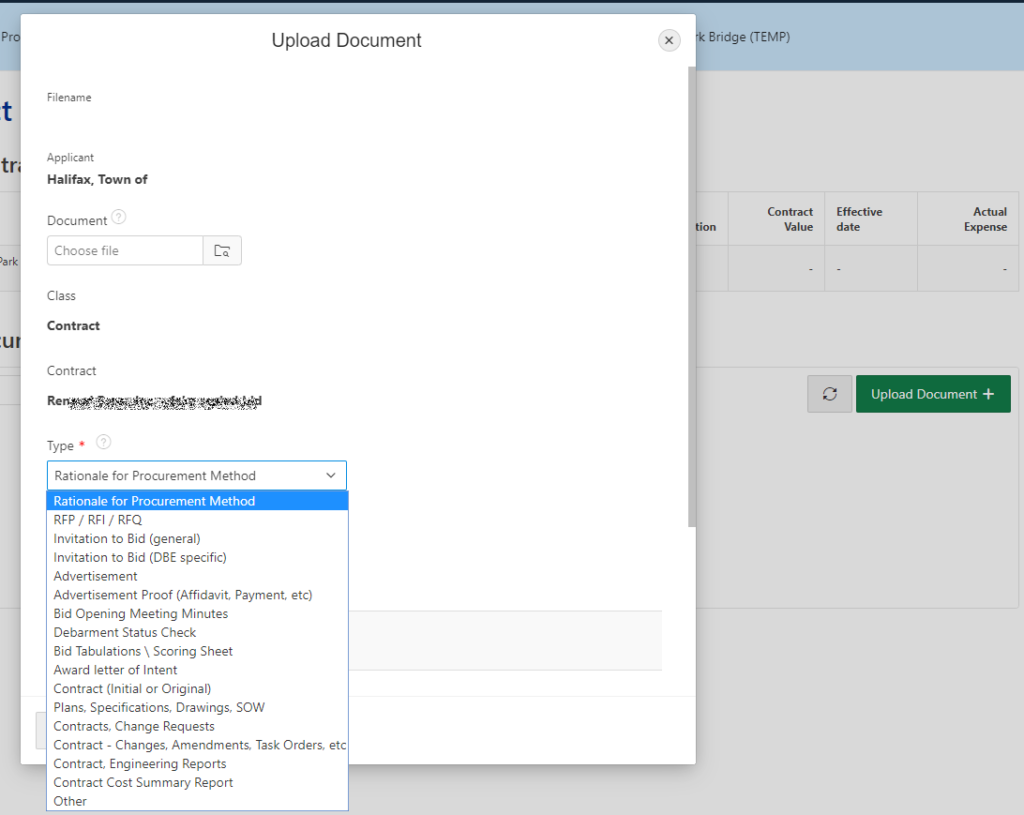

How do you upload the documents? Well there is a documents option in the contract menu. You upload one document at a time to Tempest-GEMS. Tag it with the document type. That’s what gets you the point.

Rinse, wash, repeat. By that I mean: upload, tag it, and do it again. Probably about eleven times.

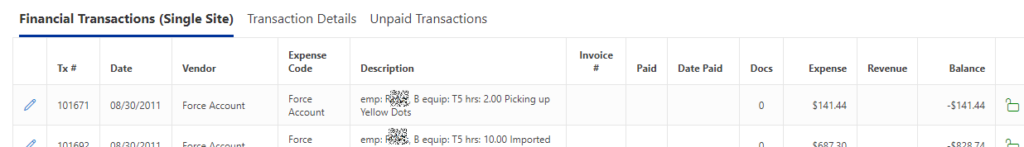

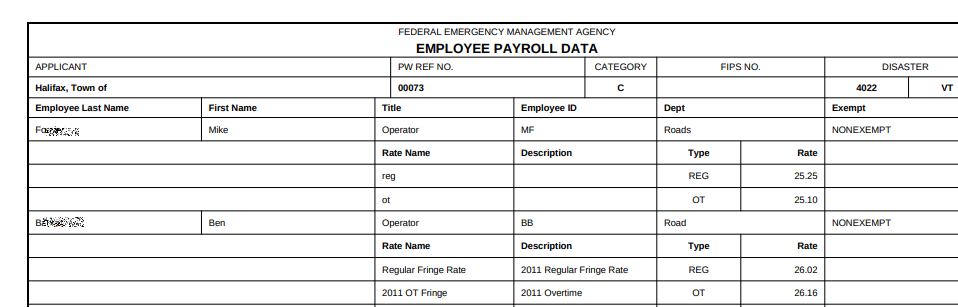

Now when you do your expense data entry, you can link that cost to a specific contract. There is a cool report in Tempest-GEMS to show your contract expenses. And Tempest-GEMS show you summaries and such provide guidance.

FEMA grant accounting requires this granularity. It will keep your process moving. It is how to manage disaster relief grants.

Sealed-Bid Closeout

The sealed-bid or competitive process is the most-favored procurement process when managing FEMA assistance grants. There are eleven steps and Tempest-GEMS provides you both the guidance and tools to help you keep score.

These eleven steps ensure a successful close out, an optimized reimbursement, and prevents issues with financial clawbacks!

Please share this material with colleagues. Post about us and our efforts on your favorite social media platform. And don’t forget to grab the Large Purchase Guide to help you get started with FEMA Quest.

Large Purchase Guide